The Penneo Incident¶

Penneo started trading on the 2nd June, 2020.

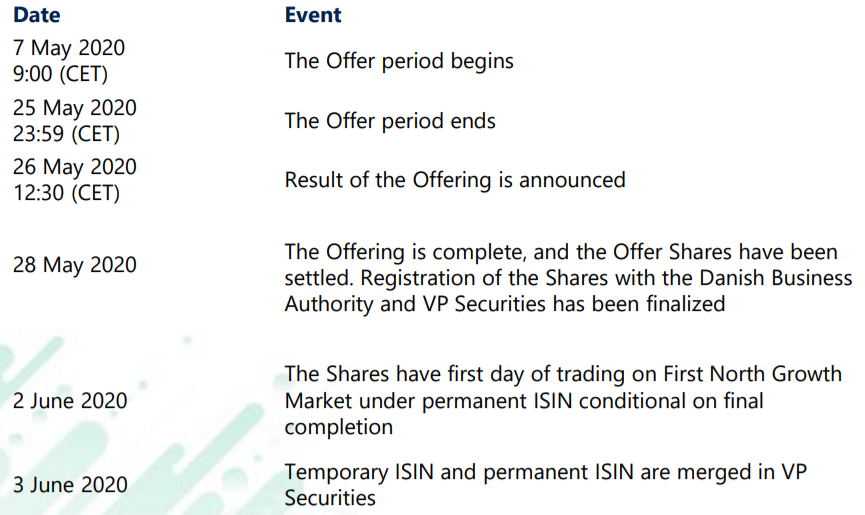

Timeline of events¶

- Offer price (corrected):

11.06

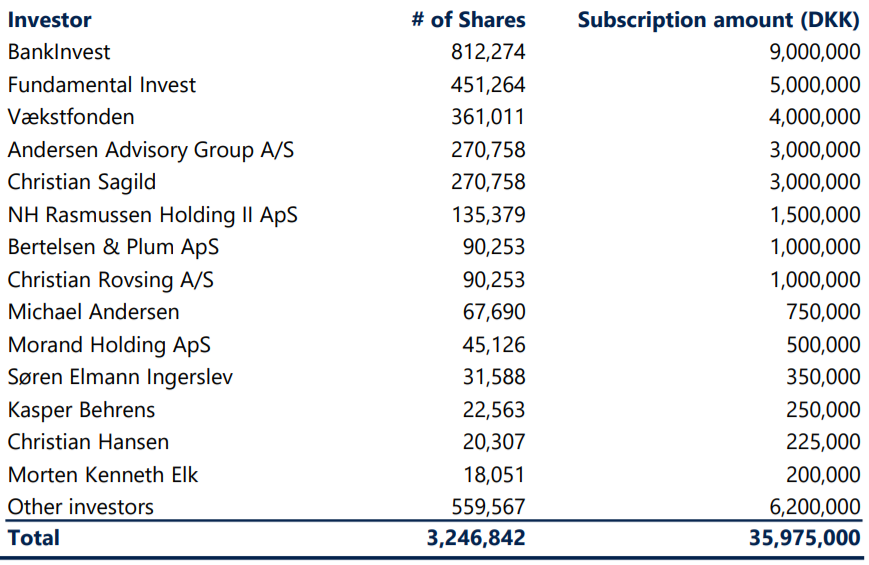

Pre-subscription¶

This is where Grant Thornton reaches out to cornerstone investors and pitches the company to them. Having good profile investors enables Penneo to carry out an effective marketing campaign (with whatever company they hired to do that).

- Pre-subscribed:

35,975 Million DKK

Subscription¶

From 5th May 2020 to 26th May 2020, we ask the public to subscribe to the shares. This doesn’t mean that the public investors get their shares. Only after the subscription period Penneo announces who gets the shares.

In total, this amounts to an oversubscription of the new shares offered of 4.7x of the total offering, and an oversubscription of 19.4x of the new shares available in the public offering. [1]

After completion of the offering the share capital of the Company will be increased from nominally DKK 412,198.64 distributed on 20,609,932 shares of DKK 0.02 to nominally DKK 502,614.56 distributed on 25,130,728 shares of DKK 0.0. [1]

Note

Layman’s analysis

Since the offering was 4.7 times, this means that there is at least 230 Million DKK (25,130,728 * 4.7) in the market so it is safe to assume that there is enough money to sustain a price of 9.15 DKK/share (230 million / 25,130,728) even if all the shares are sold at the same time.

Trading begins¶

Opened at around 27. Don’t remember the exact price.